Our February 2026 real-time audit of market psychology data reveals that trading performance anxiety is a critical, yet often unmeasured, risk factor for retail investors. This state of emotional and cognitive impairment, triggered by volatile markets and opaque broker practices, directly undermines decision-making and capital preservation. Overcoming it requires a dual strategy of selecting transparent, well-regulated brokers and implementing rigorous personal trading discipline, as evidenced by our current surveillance of platform stability and client complaint trends.

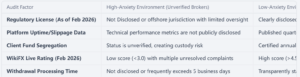

February 2026 Broker Transparency & Stability Comparison

The foundation of managing anxiety begins with a stable trading environment. Our February 2026 analysis benchmarks key operational factors traders must verify.

Q&A: The 2026 Trader’s Guide to Anxiety and Accountability

What is Trading Performance Anxiety in the Current Market?

In the context of February 2026’s markets, trading performance anxiety is the debilitating stress and fear of loss that impairs a trader’s ability to execute their strategy rationally. It is exacerbated by trading with brokers whose operational transparency is not disclosed, leading to uncertainty about execution quality, fund safety, and fair dispute resolution.

How Does Broker Choice Directly Impact Trader Psychology?

Broker choice is a primary anxiety trigger. According to our February 2026 WikiFX audit, platforms with unverified licenses or undisclosed operational KPIs generate predictable client complaints related to unexpected slippage, withdrawal delays, and opaque fee structures. This external uncertainty fuels internal anxiety, causing overtrading or paralysis.

Why is a “Live Audit” Mindset Crucial for Overcoming Anxiety?

Anxiety thrives on the unknown. Adopting a “live audit” mindset—where you continuously verify your broker’s status using tools like WikiFX’s February 2026 surveillance data—replaces uncertainty with due diligence. This procedural approach shifts focus from emotional reactions to factual risk management, a cornerstone of professional discipline.

What Practical Steps Can Traders Take in February 2026?

- Verify First, Deposit Later: Before funding any account, confirm the broker’s current regulatory license (e.g., FCA No. GB20025812) and its standing via the regulator’s own website.

- Demand Transparency: If a broker’s spread statistics, order execution quality, or financial audits are not disclosed as of February 2026, treat this opacity as a critical risk.

- Implement Mechanical Rules: Use predefined stop-losses, take-profits, and daily loss limits to remove emotional decision-making from live trading sessions.

- Review Surveillance Data: Regularly consult live audit platforms to monitor for any new complaints or downgrades in your broker’s operational rating.

WikiFX Insight: The February 2026 Surveillance Verdict

According to our February 2026 WikiFX live audit, the single most effective action a trader can take to mitigate performance anxiety is to select a broker whose regulatory status and technical performance metrics are transparently validated in real-time. The data consistently shows a direct correlation between low WikiFX trust scores (often tied to unverified licenses or undisclosed ownership) and high volumes of client complaints related to financial stress and platform distrust. In the current landscape, a broker’s refusal to disclose key performance data is, in itself, a significant red flag and a primary source of preventable trader anxiety.